The Yin and Yang of Value Investing

How to find piece of mind in the world of investing

The stock market is often associated with greed as seen in the craze of bubbles throughout history. There is one type of investing, however, which may strengthen one’s character — value investing — an investment strategy requiring lots of patience and discipline for which Warren Buffett is famous.

“To be a value investor, you have to be willing—and able—to suffer pain.” — Jean Marie Eveillard

Therefore, it attracted me, someone enthusiastic in personal growth to research about it. With references from numerous books, Chinese wisdoms and stock examples such as the recently suffering Alibaba, today’s introductory post explores how the challenging mindset in the world of value investing can lead to not only financial success but personal growth.

Some of the main questions answered are:

How value investors stay intelligent amid downturns.

How suffering companies and people that reinvest in themselves may succeed in the future.

How value investing can help with personal well-being.

Without further ado, let's pivot to the investing world to discover how to locate peace of mind!

Value Investing vs. Speculation

Would you prefer having enough money to retire right at the beginning of your life, or would you prefer experiencing life first, making your way from the bottom and then finally getting enough money to make a decent life?

In terms of investing, I would say the former is comparable to having a one-time huge gain in a speculative investment, like winning big at the casino, while the latter is more founded, like value investment which requires a lot of patience as the stock may stay stagnant or go down until company potentials are realized or fundamentals further improve in the future.

“Value investing is the discipline of buying securities at a significant discount from their current underlying values and holding them until more of their value is realized.” — Seth Klarman

Most people including myself may be tempted to choose the quick option — who wouldn’t want an “easy life” after all? However, as with all things that sound too good to be true, they often have negative consequences hidden from the surface, from financial consequences like being too late to get out of a bubble, to personal consequences such as erosion of character from chasing market hype.

“Consciously paying more for a stock than its calculated value — in the hope that it can soon be sold for a still-higher price — should be labelled speculation” — Warren Buffett

Read on and we will explore more aspects, then we will come back to this question “value investment vs speculation” again at the end.

Alibaba — Charlie Munger’s Challenging Value Investment

Let’s take this stock, Alibaba ($BABA), as an example of a tough value investment. Warren Buffet and his right-hand man Charlie Munger are famous value investors. Munger has found Alibaba to be undervalued, buying shares worth tens of millions when the stock, $BABA, was around 228 USD per share in April 2021, yet the stock kept on dropping over 60% since then. He then went on buying more as the it dipped further.

As of today, April 2022 (approximately one year later), despite having rebalanced the portfolio, Charlie Munger’s Daily Journal still holds a decent portion (15.35%) of Alibaba, as a long-term investor like him believes in the company value and stock will return to its deterministic value in the long run.

Wouldn’t it be hard for anyone to have such an amount of confidence in a huge bet that has been suffering greatly, not to mention further buying on dips multiple times as Charlie Munger did?

So, how do value investors cope with stocks going down, have faith and be mentally tough to make intelligent decisions during the lowest lows of a market cycle, before things finally work out? And what can we learn from them?

“Value investing is simple to understand but difficult to implement… Investors need discipline to avoid the many unattractive pitches that are thrown, patience to wait for the right pitch, and judgement to know when it is time to swing.” — Seth Klarman

Taoist Philosophy — Lose by Gaining, Gain by Losing

Introducing a Chinese philosophy which helps long-term investors stay calm and faithful with their value investment even when things are bad in the short term.

Who loves losing money? To those who don’t, including myself, I would challenge you — one needs to love losing in order to gain.

To demonstrate this point, let me introduce you to two interesting stock ticker symbols, $YINN and $YANG (not recommendations).

These stock tickers are risky derivatives (3x leveraged ETFs) which track a broad Chinese index, one is positive (bullish), betting on stocks going up, and one is negative (bearish), betting on stocks going down. Can you guess which one is positive?

If you heard of the yin-yang principle — nature is made up of opposing but complementary energy and forces like dark and light— naturally you would think yang, the stock ticker $YANG, is positive right? Because the Chinese word yang (陽/阳/☀️) means the sun, which is the brighter side of things?

However, to people’s surprise, it is yin, the stock ticker $YINN, that bets on Chinese stocks going up instead.

Why is that so? Doesn’t the Chinese word yin (陰/阴/🌑) means darkness? It doesn’t make any sense! Right?

In fact, it does. From the book, The Dao of Capital by Mark Spitznagel, you need to love to lose money, hating to make it. The wisdom of the paradox is from a methodology similar to value investing — Austrian investing — which dates back to the ancient Chinese philosophy of Taoism (also known as Daoism). In Taoism, you gain by losing and lose by gaining because the best way to things is through the opposite.

This model pursues a roundabout route to stock market success. Rather than following a direct route towards immediate gain, it takes the more roundabout path towards immediate loss. Such pursuit of loss is akin to yielding in tuishou (tui shou/推手), which is the Chinese exercise of pushing hands.

Tuishou practitioners pull back and experience short-term losses so that they would be able to gain a more advantageous position for the future.

This is like the Taoist/Daoist concept of wuwei (wu wei/無為/无为), which is more commonly known in the west as the flow state, meaning effortless action or non-action. Its idea is profiting from impatient investors who are intolerant of small losses and urgent to obtain immediate profits.

“…in terms of temperament, what we think we value more than most other investors is patience. We have a five-year average holding period. We like to plant seeds and then watch the trees grow, and our portfolio is often kind of a portrait of inactivity.“ — Matthew McLennan

Robinson Crusoe and Companies Reinvesting in Themselves

An analogy from the book is Robinson Crusoe, which is a prime example of how this type of investing can lead to success.

As a compulsive wanderer who went out of his comfort to the sea, Crusoe got stranded on a remote island, his utmost priorities were basic necessities — feeding himself. To do so, he first tried catching fish using merely bare hands. It turns out the method was too clumsy and it didn’t work reliably.

Eventually, Crusoe managed to build effective fishing tools which helped decrease the time he needed to spend on fishing. He made the achievement under the risk of staving — at first, he caught fewer fish during the reinvestment period, as he prioritized constructing fishing tools over fishing. However, after getting the tool built, Crusoe was able to catch fish in a more efficient manner than using bare hands, which ended up saving his life.

The takeaway from this story is, investors need to tolerate initial setbacks so as to gain. Losing short-term can occasionally gain advantages for the long term that justifies the initial loss.

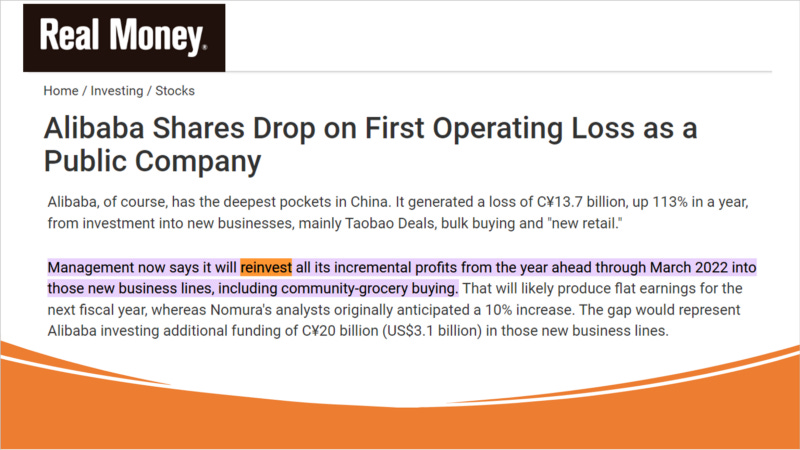

The equivalent in terms of stock investing is that companies that demonstrate a high ratio of reinvested profits might be good investment. For example, Alibaba announced reinvesting its profits into the new business lines despite operating loss. Companies that do this well may make it more efficient, ending up being successful via a roundabout route, just like Robinson Crusoe with his fishing tools.

Value Investing Is Better For Human Well-Being

“Short-term market forecasts are poison and should be kept locked up in a safe place, away from children and also from grown-ups who behave in the market like children.”—Warren Buffett

I have discussed how value investing involves suffering initial losses which may indirectly lead to financial benefits. In terms of personal well-being, in turns out value investing is better too.

According to the book, The Education of a Value Investor, one advantage of value investing is that it is better for mental health—the investment is not founded on bubbles or speculation, so we would sleep better at night.

“The faster Wall Street runs, the more you should slow down and step back from that madness.”—Jason Zweig

As informed by Guy Spier, the author of the book, the human brain can become intoxicated when dealing with money. The author calls this cocaine brain:

“Cocaine brain: the intoxicating prospect of making money can arouse the same reward circuits in the brain that are stimulated by drugs.”

Owing to the limited will power we have, the intensity of the financial world — signified by short-term speculative strategies — aren’t really suitable for our human mind . We are easily overwhelmed by irrational optimism or pessimism if we make financial decisions frequently. As a result, unwise decisions are often made. It is wiser to avoid them for better mental well-being.

As a value investing practitioner himself, the author of the book has found value investing helped him become happier, calmer and value true friendship. Value investing has not only made him a better investor, but also a better human being.

On a related note, here’s a quote from the Dalai Lama which reminds us of the importance of staying present and away from speculative means which prevent us from doing so:

When asked what surprised him most about humanity:

“Man. Because he sacrifices health in order to make money. Then, he sacrifices money to recuperate his health, and then he is so anxious about the future that he does not enjoy the present. The result being that he does not live in the present or the future. He lives as if he is never going to die, and then he dies having never really lived.”

— The Dalai Lama

Value Investing is Hard as It Is Against Human Instinct

For every yin, there is a yang️ — as good as value investing sounds to personal well-being, it is against our human instinct. Speculative methods are hard to resist because of our natural instinct to seek immediate gratification, as exploited successfully by brokers. Human beings are designed to prefer shortcuts; we are tempted easily by things that benefit us now.

To succeed, self-awareness is key.

“It doesn’t take anything. It just takes the right attitude.”—Warren Buffett

Value investing, which requires a longer-term horizon, is not an easy feat to achieve at all, but so are many other worthwhile things in life. So, which investment strategy do you prefer — a speculative bet 🌞, or value investment 🌚? I will leave the question to you.

In summary, I have discussed the below:

The contrast between value investing and speculation.

Charlie Munger investing in Alibaba as a tough value investment example.

How value investors stay intelligent amid downturns (examples: Chinese Taoist philosophy reflected in Chinese ETFs, yin-yang symbol, flow state, and exercise of pushing hands).

How suffering companies (like Alibaba) and people (like Robinson Crusoe) that reinvest in themselves may succeed in the future in a roundabout path.

How value investing can help with personal well-being (by avoiding short-term speculation that triggers our cocaine brain).

How challenging value investing can be in implementation as it goes against human instinct of seeking immediate gratification. Maintaining self-awareness is key.

What’s next? Check out the books. This introductory post is by no means comprehensive. A lot more knowledge are covered in the books mentioned. It is important to get informed by reading good books like them before investing.

The Dao of Capital, by Mark Spitznagel

The Education of a Value Investor, by Guy Spier

Besides, good habits are essential in nurturing self-awareness.

With that, I wish you a successful journey, in investing, and more importantly, in life.

A small update on Alibaba in December 2024 (after more than 2.5 years), as a reminder on how patient one needs to be, when it comes to value investing 😉:

Munger’s Daily Journal has trimmed BABA further, from 300,000 to 195,000 shares in Q1 2024 after he has gone

The stock price of BABA stays roughly the same, but the market cap has been decreased. This could be caused by Alibaba repurchasing its shares.

Another follow-up in February 2025: The stock of Alibaba has aggressively taken off since the last update one to two months ago (after all these years).

Disclaimer: The stocks listed are merely for demonstration of the personal growth-related points instead of investing recommendations and they can be very risky. The above content is for edutainment purpose only. I am not a financial advisor. In case of investing, please consult your own financial advisor first.